The attorneys at Stephens & Stephens represent policyholders in cost recovery claims against large and small insurance companies.

History of Environmental Insurance Law in New York State

Prior to 1966, standard Comprehensive General Liability (CGL) policies provided coverage for injuries caused by “accident” (i.e., a fortuitous event, beyond the control of either party).

In 1966, the insurance industry changed to occurrence-based coverage practices, so that, after 1966, an “occurrence,” rather than an “accident,” triggered the standard CGL policy. An “occurrence” was usually defined as “an accident, including continuous or repeated exposure to conditions, which resulted, during the policy period, in bodily injury or property damage neither expected nor intended from the standpoint of the insured.” In New York State, for the purposes of “per accident” policy limits, occurrences are separated within a causal chain based upon the “unfortunate event” test, which groups multiple injuries as a single “occurrence” where they (1) arise out of the same event of unfortunate character that takes place without foresight or expectation, and (2) occur close in time with no intervening agent. Occurrences are separated within a causal chain based upon the wording of the policies, the contracting parties’ actions or conduct prior to the commencement of litigation, and New York law interpreting the word “occurrence.”

Under controlling New York law, occurrence-based CGL policies are triggered by “injury in fact” (i.e., an actual injury). Under this approach, all of the policy periods during which an insured proves some injury or damage are implicated, regardless of when the exposure occurred or when the injury was discovered. In the property damage context, this approach has been translated into a “damage-in-fact” trigger. Where property damage is caused by pollution, the key damage occurs upon contact of the contaminants with the land. So, where an insured property is contaminated, “damage” may be equated with “discharge”; but, where a third-party property is contaminated through the gradual seepage of pollutants emanating from an insured’s property, coverage is triggered not upon mere discharge, but only at the time that the pollutants reached, and so contaminated, the third-party property. Under those circumstances, “damage” may not be equated with “discharge.” There may be a “continuous trigger” where injuries-in-fact (or damages-in-fact) arose, more likely than not, continuously, incrementally, or cumulatively, during every consecutive policy period (and or consecutive policy) in a given series (e.g., in cases of the gradual contamination of earth and groundwater by leaking landfills, or in cases of progressive bodily disease, where every reproduction of damaged cells constitutes a new injury). In cases where consecutive policies are each triggered, liability is usually to be apportioned equitably (pro rata), in proportion to each insurer’s time on the risk.

From 1971 to 1982, New York State required all commercial and industrial policies to include a pollution exclusion clause, to ensure that corporate polluters bore the full burden of their environmentally harmful actions. In CGL policies before 1985, the clause usually took the form of a “qualified pollution exclusion,” which broadly excluded all specified polluting discharges or releases, except where those discharges or releases were “sudden and accidental.” A typical qualified pollution exclusion clause might read, “This insurance does not apply to bodily injury or property damage arising out of the discharge, dispersal, release, or escape of smoke, vapors, soot, fumes, acids, alkalis, toxic chemicals, liquids or gases, waste materials or other irritants, contaminants or pollutants into or upon land, the atmosphere, or any watercourse or body of water, but this exclusion does not apply if such discharge, dispersal, release, or escape is sudden and accidental.” “Sudden” has been defined as “abrupt, precipitant, or brought about in a short time.” “Accidental” has been defined as “unexpected and unintended.”

In 1982, New York State amended the law to allow insurers to provide coverage for pollution, as part of a larger effort to encourage industry to handle hazardous wastes responsibly, and to safeguard the public from the consequences of rendering hazardous waste handlers financially disabled. Even after this statutory change, pollution exclusions were still incorporated into CGL policies, but after 1985, they were usually of a new generation: the “absolute pollution exclusion.” Apparently, these newer clauses gained popularity because of insurance companies’ dissatisfaction (1) with the great expense of environmental litigation over conflicting interpretations of the terms “sudden and accidental,” and (2) with the eventual judicial constructions meant to resolve these conflicting interpretations. Absolute (or “total”) pollution exclusion clauses contain no exceptions for sudden and accidental incidents, but exclude from coverage all liability based on intentional discharge (exposure), regardless of whether the consequential damages (injuries) were intended or not.

Share this:

EEOICPA CLAIMS

If you or your parent worked any of the DOE or AWE facilities listed on this website and became ill, you may be entitled to compensation of up to $400K plus medical benefits from the US Department of Labor.

Call EEOICPA Counsel Hugh Stephens at 1-800-548-4494, email hstephens@stephensstephens.com, or fill out the form below whether or not you have already filed a claim and even if your claim has been accepted or denied.

Contact Us

"*" indicates required fields

*note: Submission of this form does not establish an attorney-client privilege.

Contact Us

Address:

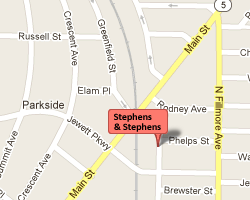

2495 Main Street, Suite 442

Buffalo, New York 14214

Phone:

(716) 852-7590

Fax:

(716) 852-7599

After Hours:

(716) 208-3525

Email Us:

R. William Stephens, Esq.

R. Hugh Stephens, Esq.

Lisa P. Neff, Esq.