When a corporation is faced with significant environmental liability, it may find itself insolvent (i.e., in such a financial state that the corporation’s liabilities outweigh its assets). Upon insolvency, the duty of the directors and officers to the corporate shareholders shifts, and becomes a duty to the corporate creditors. So, if the directors and officers of the corporation sell the assets of the corporation and distribute the proceeds to the shareholders, their actions, which may be described as fraudulent conveyances and breaches of fiduciary duty, subject the directors and officers to personal responsibility for the liabilities of the corporation.

A more appealing option for the directors and officers of an insolvent corporation faced with CERCLA liability is to file for bankruptcy and attempt to sell the corporation’s valuable assets with the benefit of the sanction of the Bankruptcy Court. If the corporation chooses this route, it enjoys the option of selling the assets to a related corporation with the approval of the Court, and so the assets may be purged of the outstanding CERCLA liability upon the transfer. Also, the officers and directors of the corporation are afforded protection from personal liability. The creditors of the corporation are left only with claims against the bankrupt estate, managed under the Bankruptcy Code. The Bankruptcy Code operates to ensure that each creditor is paid its pro rata share of the remaining assets, adjusted for priority and security interests.

Stephens & Stephens has become proficient in the operation of the United States Bankruptcy Code as well as the New York Debtor and Creditor Law through representation of corporate clients in CERCLA disputes. We see bankruptcy as a lawful option for a corporate client’s release from CERCLA liability, and we represent claimants with broad knowledge of:

- Chapter 7 Liquidations

- Chapter 11 Liquidating Plans

- Chapter 11 Liquidating Plans of Reorganization

- Claims for Breach of Fiduciary Duty

- Claims for Fraudulent Conveyance

- Claims for Accounting

- Claims for Unjust Enrichment

Share this:

EEOICPA CLAIMS

If you or your parent worked any of the DOE or AWE facilities listed on this website and became ill, you may be entitled to compensation of up to $400K plus medical benefits from the US Department of Labor.

Call EEOICPA Counsel Hugh Stephens at 1-800-548-4494, email hstephens@stephensstephens.com, or fill out the form below whether or not you have already filed a claim and even if your claim has been accepted or denied.

Contact Us

"*" indicates required fields

*note: Submission of this form does not establish an attorney-client privilege.

Contact Us

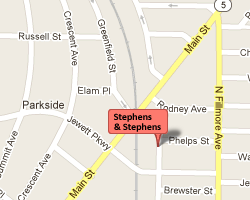

Address:

2495 Main Street, Suite 442

Buffalo, New York 14214

Phone:

(716) 852-7590

Fax:

(716) 852-7599

After Hours:

(716) 208-3525

Email Us:

R. William Stephens, Esq.

R. Hugh Stephens, Esq.

Lisa P. Neff, Esq.